Voluntary Retirement Happiness: Planning a Life of Fulfillment After Retirement:

In many traditional households, it’s believed that the later part of life—after one has fulfilled all responsibilities—is meant for spiritual reflection, contemplating Krishna or Rama, and seeking inner peace. If one reaches sixty with good health, it’s considered a “V’shesha” or special life. However, the modern perspective on retirement is shifting. Today, retirement is no longer just about winding down; it’s about doing what you love, on your own terms, without racing against time.

With early planning, this isn’t just a dream—it’s an achievable lifestyle. Voluntary Retirement

The Voluntary Retirement Daydream

From the day an average employee joins the workforce, retirement becomes a far-off dream they often think about. In rare quiet moments at work, they might close their eyes and imagine: a cozy farm, a small cottage nestled in it, a snowy morning, thick coffee, and heartfelt conversations with a spouse. It’s a scene of serenity—until reality brings them back with a colleague’s knock.

But here’s the truth: with smart planning, that dream can become reality.

A person who has worked tirelessly for forty years and retires at sixty can certainly afford a small farm and even a better-than-expected cottage. But here’s the catch—by that age, enjoying heavy snowfall might be more of a burden than a pleasure. That thick coffee may come with a reminder from your spouse: “Did you take your sugar tablet?”

So, what’s the point of earning all that money if the joy is delayed too long?

That’s why more and more people today are choosing voluntary retirement—opting to enjoy life while still healthy and active. As the Tata slogan suggests, it’s about living the rest of your life in a special way.

Chasing Happiness, Not Just Money

“You must have fire to achieve anything,” the elders say. That fire today is being channeled into a new kind of movement: FIRE – Financial Independence, Retire Early.

Let’s take a practical look at this. Suppose someone wants to buy a basic model car today—it costs about ₹3.5 lakhs. A person like Kantarao, who once believed he could buy two cars and a house with his insurance money, is now realizing that prices and realities have changed. What seemed like a solid plan now feels like an illusion.

For those who don’t understand this, the world feels deceptive. But those who do understand know one important truth: the value of money depends on inflation.

Whether it’s insurance or investment, everything is about preparing for the future. But here’s the key: the return on that investment must beat inflation. If not, the money you’re saving is slowly losing value.

Let’s break it down:

-

Ten years ago, a couple could live comfortably on ₹10,000/month.

-

Today, that same couple might need ₹25,000 or more.

-

The culprit? Inflation.

In India, the general inflation rate hovers around 7%. So, unless your investments are giving you a return higher than that, you’re not actually growing your wealth. In sectors like education and healthcare, inflation rates are even higher—12% and 14% respectively.

So, a 12% return should be your benchmark for profitable investment.

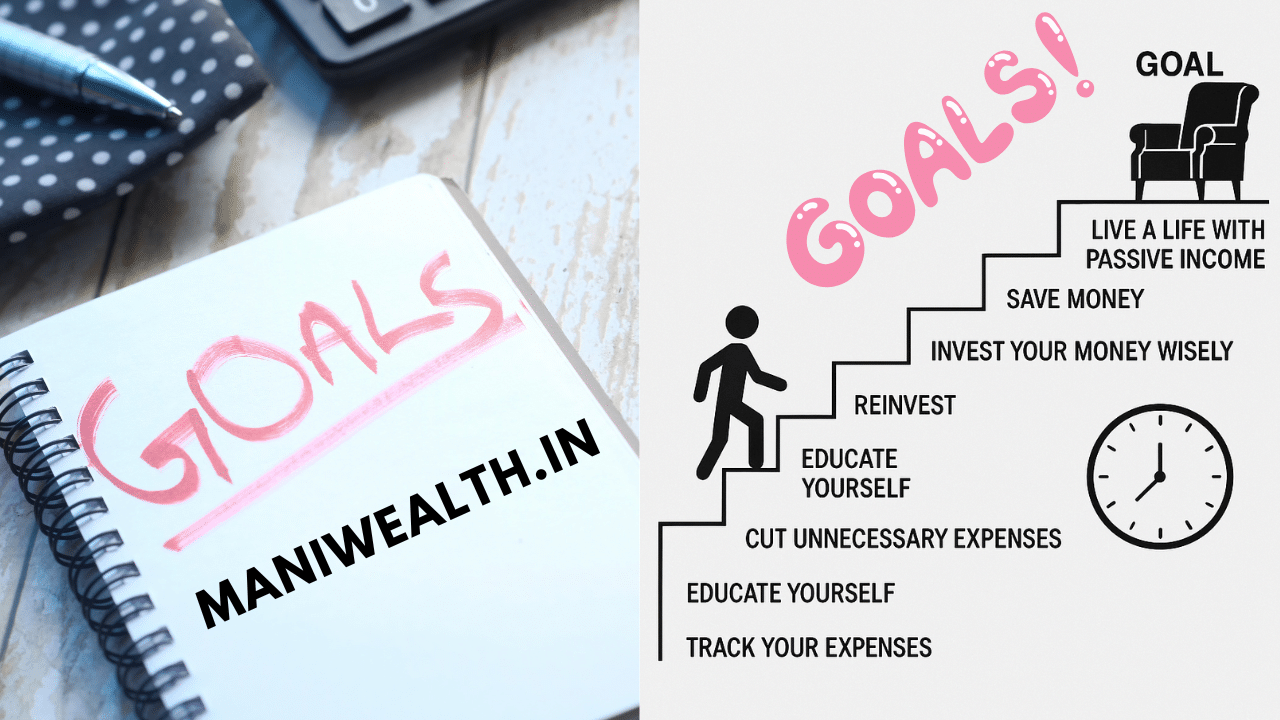

Set Clear Financial Goals

The foundation of voluntary retirement is built on clear and measurable goals. Goals give your financial journey direction and purpose. Whether short-term or long-term, having defined goals allows you to:

-

Track your progress

-

Adjust your investments accordingly

-

Stay motivated, even when challenges arise

Here are some examples of goals to set:

-

Short-term (1–3 years):

-

Build an emergency fund with 6–12 months of living expenses

-

Pay off credit card or personal loan debt

-

Invest in a skill or certification for better income

-

-

Medium-term (3–7 years):

-

Buy a vehicle or renovate your house

-

Accumulate a down payment for property

-

Save for children’s early education

-

-

Long-term (10+ years):

-

Build a retirement corpus

-

Plan for your children’s higher education or marriage

-

Purchase a second home or vacation property

-

Start your dream farm or passion project

-

Goals help you prioritize what’s important. Without them, your savings and investments lack purpose. Think of each goal as a milestone toward a happier, freer future.

Planning for the Future

There’s no financial principle more powerful than this: ensure your expenses don’t exceed 50% of your income.

The remaining 50% should be saved and invested wisely. Even if a portion of that is simply placed in a bank for emergencies, it provides a safety net.

When it comes to investment:

-

Look for reliable options that offer more than 7% returns.

-

Mutual funds are a good choice, even with short-term volatility.

-

Be mindful of long-term inflation and invest accordingly.

You should be able to visualize the future. Look at how life changed over the past decade—now imagine what it might look like ten years from now. Let your financial decisions align with that foresight.

For example, it’s not enough to save ₹10 lakhs now for your daughter’s wedding if it’s ten years away. You need to think smart: Where should I invest that ₹10 lakhs so that it grows to ₹1 crore by then?

Final Thoughts

Voluntary happiness is not just about early retirement. It’s about timing your joy, prioritizing your health, setting realistic goals, and investing with wisdom. If you plan it right, you can live a life where responsibilities are fulfilled, and dreams aren’t delayed until old age.

You deserve a retirement where the coffee is thick, the cottage is warm, and the happiness is real—not postponed.

✨ About Me

Hi! I’m Manikanta Reddy, a passionate finance enthusiast with a strong understanding of money management, personal finance, and smart investment strategies. I believe financial literacy is the foundation of a secure and stress-free life — and I’m here to share practical insights, real-life examples, and simplified advice to help you make better financial decisions.

Whether it’s choosing between paying off a loan or investing, building emergency funds, or planning for retirement — I love breaking down complex topics into easy, actionable tips that anyone can follow.

Let’s learn, grow, and build wealth — the smart way. 💰