When to Play the SIP Puzzle: Don’t Miss the Real Clues in Your Financial Game

Financial planning is like solving a puzzle. Just like a crossword where horizontal and vertical clues must align, financial strategies also need synchronization. If you skip filling the first word in the horizontal row or ignore the second in the vertical column, your Sunday pastime turns frustrating. Likewise, if you ignore essential needs in your investment journey, you may never see real profits—even if your investment choices look right on the surface.

The SIP Hype: The Golden Goose or a Misstep?

The moment a salaried individual is left with a little extra—four salary “stones” in hand—their thoughts often turn to Systematic Investment Plans (SIPs) and mutual funds. These options are touted as golden geese, promising high returns and long-term gains. But in the rush to invest, many ignore their own financial needs and priorities.

Just like you need to be 18 to vote, there are basic prerequisites before diving into SIPs. If you’re not ready, even the best investment plans won’t solve your financial problems—they might complicate them.

Without Insurance, There Is No Foundation

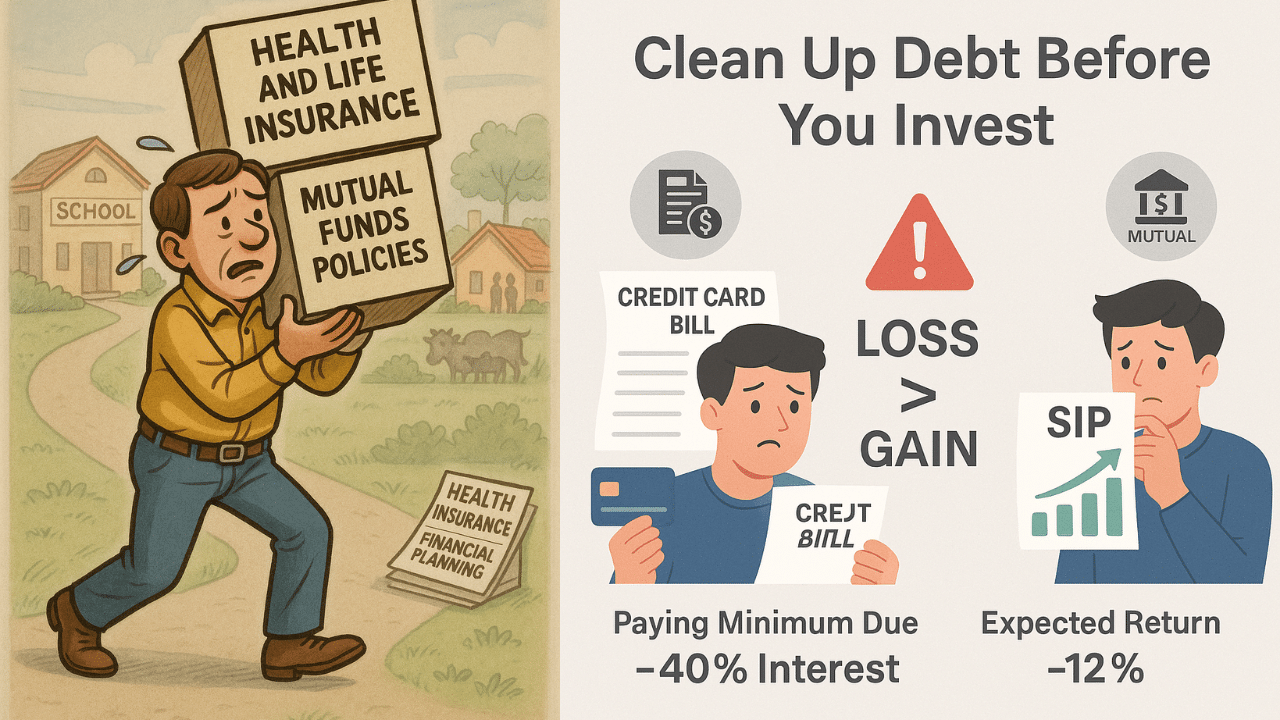

No structure can stand strong without a solid foundation. Similarly, a middle-class employee believing that SIPs alone will lead to financial freedom is making a critical mistake.

Before making any investment, every individual must first ensure they have proper health insurance for the family and term life insurance for themselves. These are the two protective shields that guard your financial journey.

Never start a SIP without insurance. If you’ve already started, and don’t have health and life coverage, it’s wise to pause—even if it means breaking the SIP—to get insured first. It’s better to miss some investment growth than risk everything in a crisis.

The ₹1 Crore Dream: Are You Sacrificing Needs for Numbers?

We often hear a popular formula: Invest ₹15,000 a month for 15 years and earn ₹1 crore. It’s tempting. If you double it to ₹30,000, you could have ₹2 crore. This leads people to sacrifice essential expenses in pursuit of long-term wealth—building a financial ladder to the sky while ignoring the ground beneath their feet.

Take the example of an employee earning ₹1 lakh a month. He begins a ₹15,000 monthly SIP without health insurance. Two years later, an unexpected accident leads to a ₹10 lakh surgery. When he tries to withdraw from his SIP, he finds it’s worth only ₹5 lakhs. Had he spent ₹30,000 annually on health insurance instead, he would have had coverage worth ₹15 lakhs—and wouldn’t have spent a rupee from his savings.

Now imagine the worst—if his life had been at risk, would those two years of SIP savings have been enough to support the family?

Why Borrow to Invest?

Some believe SIPs and mutual funds will bring windfall gains, so they go one step further—they borrow to invest. They take personal loans and channel them into SIPs, convinced they’re playing it smart.

But SIPs, even on a good day, deliver around 12–14% annual returns. A personal loan also costs about 14%—sometimes more. So you’re not gaining, you’re breaking even at best and adding financial risk.

More importantly, investments should reflect financial needs, not emotional desires. If you’ll need the money in the next 1–2 years, avoid equity investments. First, allocate funds for health and life insurance, then look at investment options. Only then will you truly qualify as a smart investor.

Still Paying the Minimum on Your Credit Card? SIP Can Wait.

If you’re only able to pay the minimum due on your credit card, investing isn’t your next step—it’s financial cleanup.

Credit card interest rates can go up to 40%, while your SIP might offer a 10–15% return. You’re losing more than you’re gaining. The same goes for taking a top-up on a home loan to invest in SIPs—it’s a dangerous strategy that often feels like success until the losses catch up.

The damage might not show in a few weeks or even months—but eventually, it does.

Final Thought: Complete the Puzzle First

SIPs are an excellent tool for long-term wealth creation, but only after you’ve built the right foundation:

✅ Health insurance in place

✅ Term life insurance secured

✅ No high-interest debt (like credit cards or personal loans)

✅ Emergency fund ready

✅ Short-term financial needs covered

Only then can you confidently p

lay the SIP puzzle—and complete the last square with satisfaction and peace of mind.

✨ About Me

Hi! I’m Manikanta Reddy, a passionate finance enthusiast with a strong understanding of money management, personal finance, and smart investment strategies. I believe financial literacy is the foundation of a secure and stress-free life — and I’m here to share practical insights, real-life examples, and simplified advice to help you make better financial decisions.

Whether it’s choosing between paying off a loan or investing, building emergency funds, or planning for retirement — I love breaking down complex topics into easy, actionable tips that anyone can follow.

Let’s learn, grow, and build wealth — the smart way. 💰

1 thought on “When Should You Play the SIP Puzzle? sip-investment-readiness”