Share back.. Profit up!

Sometimes it seems like a better decision to let go than to hold on. Just as Akshaya Patra took care of the Pandavas who gave up their kingdom and went to exile.. SEBL stands by Mutual Funds investors. With this systematic withdrawal plan, you can receive as much share as you want from your quota every month as a pension while increasing your capital.

You invest in Mutual Funds through SIP. If the market goes up.. you want to withdraw your investment on the fly. If the market goes down.. you feel like all your hard work has been wasted. Do not succumb to these temporary emotions in the long-term journey. Whether the market goes up or down, you should continue to invest in Mutual Funds. After continuing SIP for fifteen years.. then SWP should be activated based on the available capital.

As you do SIP every month.. a fixed percentage amount will be deposited in your account every month. For example, suppose you have Rs. 25 lakhs in mutual funds. If you invest six percent of it in SWP.. Rs. 12.5 thousand will be deposited in your account every month. You will receive Rs. 1.50 lakhs per year. At the same time, even if you calculate at a rate of 13 percent return, your mutual funds total will reach Rs. 26 lakhs. Isn’t it a great thing to see capital increase even if you are receiving Rs. 15 thousand per month!

Monthly income

Don’t doubt that SWP is not applicable to those who do not do SIP monthly. If you can invest a large sum in mutual funds at once, like you do in an FA in a bank, you can get more income than you expected every month. For example, let’s say a person invests Rs. 1 crore in mutual funds. He chooses the 6% SIWP option. He gets an income of Rs. 50 thousand per month.

That is, Rs. 6 lakh per year. If the market falls significantly this year, that will have an impact on the capital. Your investment may decrease by up to 20 percent. However, there is no need to worry. If the next bull runs hard, the situation will be set. If you can continue mutual funds without being afraid of bull runs and bear aggression… If a person who has invested Rs. 1 crore takes Rs. 50 thousand (6 percent) per month through SEWP… after ten years, his capital will reach about Rs. 2 crore. If that person takes Rs.60 lakhs in ten years at the rate of Rs.6 lakhs per year..

it is important to note that the capital doubles. When the capital reaches two crores.. then the SE BlueP will receive Rs.1 lakh (6 percent) per month. Again, the capital will fall to around Rs.4 crores in ten years. It is not credible that we received Rs.1.20 crores in these ten years at the rate of Rs.1 lakh per month. All this is possible with an investment of Rs.1 crore.

Try it..

Monthly Income, Whether or Not You SIP

You might be wondering: Is SWP only for those who have done monthly SIPs? Not at all.

Even if you invest a lump sum—just like putting money in a bank fixed deposit—you can generate steady income. Let’s say someone invests ₹1 crore in mutual funds and chooses the 6% SWP option. That’s ₹50,000 per month or ₹6 lakhs per year.

Now, let’s be real—the market won’t always be kind. A bad year could reduce your capital by 20%. But history has shown us that the next bull run usually sets things right. If you stay calm and committed, your ₹1 crore could potentially double to ₹2 crores in ten years, even after withdrawing ₹6 lakhs each year.

At this point, your monthly withdrawal can increase to ₹1 lakh—and the cycle continues. Over the next ten years, this same capital could rise to ₹4 crores, while you would have received a total of ₹1.2 crores in payouts. All from an original investment of ₹1 crore!

No return

Leave aside the market fluctuations and how much the investment has increased or decreased. If you look at the statistics of the last twenty years, the average returns of mutual funds are just over 13 percent. If you do not touch it on this basis, the capital will almost double every five years. If you choose the same SWP option, the value of the room doubles every ten years. Even if the market falls unexpectedly one year and rises steadily the next, those hoping for long-term benefits need not worry.

The Power of SIP + SWP

Let’s be honest—investing in Mutual Funds through SIP (Systematic Investment Plan) is a rollercoaster ride. When the market goes up, the urge to cash out is strong. When it goes down, it feels like your hard work is slipping away. But here’s a truth that most successful investors live by: ignore short-term emotions in a long-term journey.

If you stick to your SIP diligently for 15 years, you can then activate SWP based on your accumulated capital. With SWP, you’ll receive a fixed monthly amount—almost like a pension—while your capital continues to grow.

Here’s an example:

Say you’ve built up ₹25 lakhs in your mutual fund portfolio. By choosing to withdraw 6% per year through SWP, you’ll receive about ₹12,500 every month—that’s ₹1.5 lakhs annually. Meanwhile, even if your investment grows modestly at 13% annually, your corpus could increase to ₹26 lakhs.

So, you’re withdrawing money and watching your capital grow at the same time! How’s that for a win-win?

Can’t Start with ₹1 Crore? Start Smaller

You don’t need a crore to benefit from this strategy. Start with ₹25 lakhs. Or even ₹10 lakhs. If you invest a portion of your retirement fund into mutual funds and opt for SWP through SEBL, you could enjoy a stable monthly income.

For instance, ₹10 lakhs invested could give you ₹5,000 per month—that’s ₹8 lakhs over ten years—and your capital could double to ₹20 lakhs over the same period. In contrast, if you had parked that money in a bank FD, you might get only ₹6,000 per month with no significant capital appreciation—even after 15 years.

So why hold on to investments that stay stagnant? Let go of fixed returns, and embrace growing income. Mutual funds with SWP let your money breathe, expand, and serve you better during retirement.

Forget the Fluctuations—Look at the Bigger Picture

Forget the noise about market volatility. Over the past two decades, mutual funds have delivered average returns of over 13%. Based on this, your capital could double every five years. And if you use the SWP option smartly, the returns can multiply even more over time.

Even if the market dips one year and rises the next, those committed to long-term gains have little to worry about. The key is consistency and patience.

Final Word: Let Your Investment Serve You

Don’t get emotional over market ups and downs. Let your SIPs grow quietly in the background. Then, activate SWP and let your capital give back to you—month after month, year after year.

Start with what you can. Try it. Stick with it. Let it grow. Share back. Profit up!

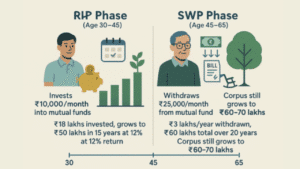

Example: SIP + SWP Strategy for Wealth Creation and Monthly Income

Goal:

Build a retirement income stream using SIP during working years and SWP during retirement.

Meet Rajesh

-

Age when starting SIP: 30 years

-

SIP amount: ₹10,000 per month

-

Investment period: 15 years

-

Assumed average return: 12% per year

Phase 1: SIP Growth Phase (30 to 45 years)

Rajesh invests ₹10,000/month for 15 years = ₹18 lakhs total invested.

Using a 12% annual return, his investment grows to approximately:

₹50 lakhs by age 45

Phase 2: SWP Withdrawal Phase (45 to 65 years)

Now Rajesh stops SIP and activates SWP to receive monthly income while still letting the remaining amount grow.

-

SWP Withdrawal: ₹25,000/month (₹3 lakhs/year)

-

Return on remaining amount: 12% per year

-

Duration: 20 years

During this 20-year SWP period:

-

Rajesh withdraws ₹60 lakhs in total (₹25,000 x 12 x 20)

-

Despite withdrawing ₹60 lakhs, his corpus could still grow to over ₹60–70 lakhs by age 65

(Exact value depends on market behavior, but historically plausible with a 12% return)

Summary at Age 65

| Metric | Amount |

|---|---|

| Total Invested (SIP) | ₹18 lakhs |

| Total Withdrawn (SWP) | ₹60 lakhs (₹25k/month) |

| Corpus at Retirement End | ₹60–70 lakhs (approx.) |

🔁 Invested once, earned for decades.

Key Takeaway:

Rajesh used a simple strategy:

-

Build wealth during earning years (SIP)

-

Create steady income during retirement (SWP)

-

Enjoy growth even during withdrawals

This is a real, achievable path for anyone planning long-term.

✨ About Me

Hi! I’m Manikanta Reddy, a passionate finance enthusiast with a strong understanding of money management, personal finance, and smart investment strategies. I believe financial literacy is the foundation of a secure and stress-free life — and I’m here to share practical insights, real-life examples, and simplified advice to help you make better financial decisions.

Whether it’s choosing between paying off a loan or investing, building emergency funds, or planning for retirement — I love breaking down complex topics into easy, actionable tips that anyone can follow.

Let’s learn, grow, and build wealth — the smart way. 💰

Good information brother