Should You Repay Your Home Loan Early or Invest Instead? A Tale of Two Friends

🧑🤝🧑 Two Friends, One Apartment, Two Financial Paths

Sudhakar and Prabhakar, both 35 years old, work at the same company and earn about ₹70,000 per month. They live in the same apartment complex, in flats opposite each other. Their stories start similarly but take very different financial turns — one decided to repay his home loan early, the other chose to invest the surplus amount. Should You Repay Your Home Loan Early or Invest Instead? A Tale of Two Friends

📊 The Setup: Same Loan, Different Decisions

Both Sudhakar and Prabhakar bought flats worth ₹40 lakhs each.

-

They paid ₹10 lakhs upfront

-

Took home loans of ₹30 lakhs

-

Loan tenure: 25 years

-

Interest rate: 7.5%

-

EMI: ₹22,169/month

🔁 Sudhakar’s Approach: Pay Off the Loan Early

Sudhakar calculated that over 25 years, he’d end up paying a total of ₹66,50,700 — more than double the principal. Determined to save on interest, he increased his EMI to ₹35,610 and planned to close the loan in 10 years, paying a total of ₹42,73,200 — saving nearly ₹23.77 lakhs in interest. Should You Repay Your Home Loan Early or Invest Instead? A Tale of Two Friends

He felt proud of this decision.

📈 Prabhakar’s Strategy: Stick to EMI, Invest the Rest

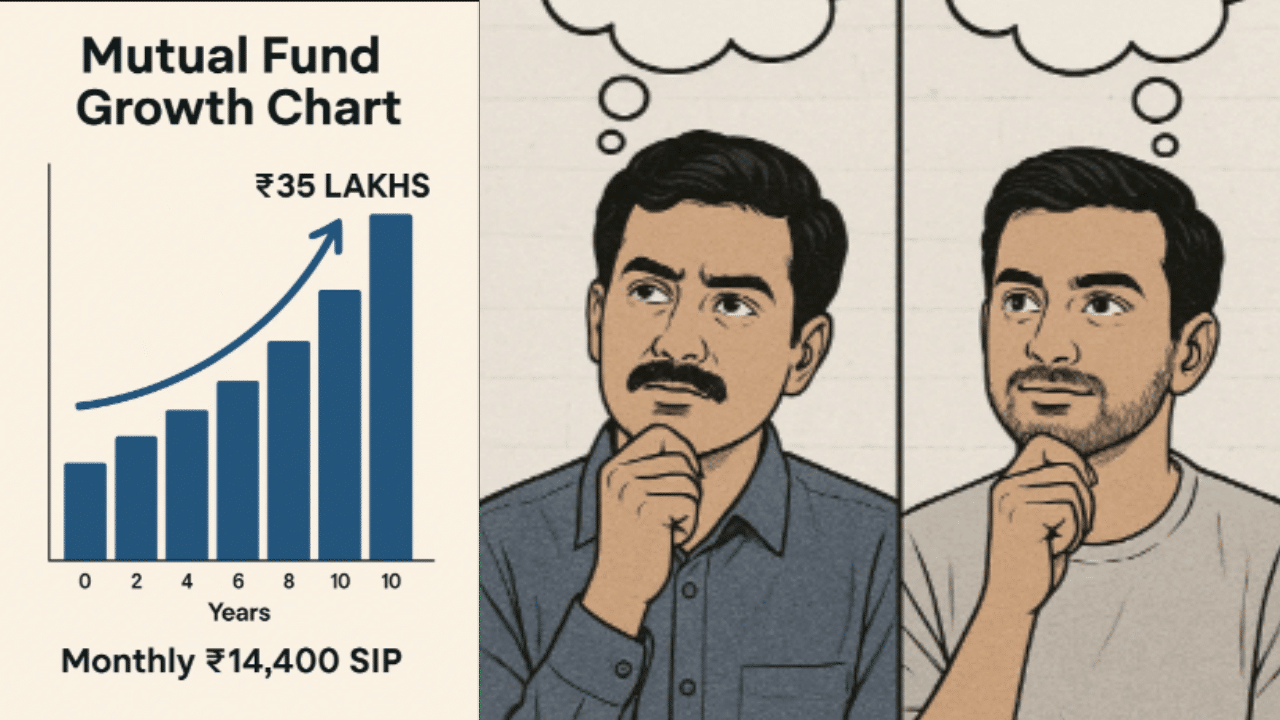

Prabhakar, on the other hand, continued paying ₹22,169 as EMI and invested the remaining ₹14,400 every month in a large-cap mutual fund through SIP.

After 10 years, his SIPs yielded a return of ₹35 lakhs.

He used ₹23.91 lakhs to clear his remaining home loan and still had ₹11 lakhs left as profit.

🚨 When Crisis Hits: Job Loss Scenario

After 7 years, both friends lost their jobs as their company shut down.

-

Sudhakar, who was paying higher EMIs, had no savings. He struggled to pay his loan and was forced to borrow at high interest rates. The pressure took a toll on his health.

-

Prabhakar had nearly ₹19.5 lakhs in his mutual fund. Even without a job, he could comfortably withdraw ₹60,000/month for the next 32 months, buying him enough time to find new employment — stress-free.

💡 The Financial Lesson: Not All Debt is Bad

Should You Repay Your Home Loan Early or Invest Instead? A Tale of Two Friends

Many people rush to repay home loans fearing “lifelong debt.” But here’s the truth:

-

Home loans are considered good loans

-

They come with low interest rates (7%–8.5%)

-

Income tax benefits make the effective interest even lower (5.5%–6%)

In short, home loan interest is one of the cheapest in the market. Instead of repaying it early, using your surplus money to invest can generate higher returns — if done wisely.

🏦 Why You Need Liquid Assets

While real estate is a good long-term asset, it lacks liquidity. Selling it in emergencies isn’t easy.

On the other hand, mutual funds (especially SIPs) offer:

-

Liquidity — withdraw within 3 days

-

Flexibility — increase your SIP as income grows

-

Access to emergency funds — without high-interest personal loans

-

Quick loans — with no CIBIL dependency

You can also consider gold as a liquid asset, but emotional attachment often makes people hesitant to sell when needed. While real estate is a solid long-term asset, it has one major drawback — lack of liquidity. Selling a property during an emergency is not always easy or quick. It depends on market demand, paperwork, and the right buyer — all of which take time. Also, the selling price may not match your expectations when you’re in urgent need of cash. (Should You Repay Your Home Loan Early or Invest Instead? A Tale of Two Friends)

💸 The Power of Liquid Assets

This is where liquid assets like mutual funds, gold, or fixed deposits come in. They are easy to convert to cash when you need them most.

✅ Benefits of Mutual Funds (especially SIPs):

-

🔁 Liquidity — You can withdraw funds within 2–3 working days. Ideal for emergencies or unexpected expenses.

-

📈 Flexibility — You can increase or pause your SIP anytime based on income and goals. There’s no lock-in like some traditional plans.

-

🚨 Emergency Support — Access emergency funds without taking a high-interest personal loan or liquidating long-term investments.

-

🪪 No Credit Score Dependency — You can take instant loans against mutual fund units without worrying about CIBIL score or income proof. Many financial platforms and apps offer this now.

💰 Real-Life Tip:

Imagine a medical emergency or job loss. Would you rather try to sell a flat (which could take months) or have ₹5–10 lakhs available within 2–3 days through your mutual funds or gold loan?

That’s the power of liquidity.

🟡 Bonus: Gold as a Liquid Asset

-

Easily pledged for a loan

-

Instant loan approval in banks or gold loan companies

-

But: Emotional attachment may make people hesitate to sell

💬 Pro Tip: Build a mix of liquid and fixed assets to balance returns and emergency readiness.

📌 Final Verdict: Should You Repay a Home Loan Early or Invest?

Should You Repay Your Home Loan Early or Invest Instead? A Tale of Two Friends

| Scenario | Sudhakar (Repay Early) | Prabhakar (Invest) |

|---|---|---|

| Interest Paid | ₹12.73 lakhs | ₹36.5 lakhs |

| Surplus Investment | None | ₹35 lakhs |

| Emergency Fund | None | ₹19.5 lakhs after 7 years |

| Stress in Crisis | High | Low |

| Net Financial Gain | Lower | Higher (₹11 lakh profit after loan closure) |

👉 Conclusion: If you can manage your home loan EMI and invest the rest, you are likely to end up financially stronger, with more flexibility and better returns.

✨ About Me

Hi! I’m Manikanta Reddy, a passionate finance enthusiast with a strong understanding of money management, personal finance, and smart investment strategies. I believe financial literacy is the foundation of a secure and stress-free life — and I’m here to share practical insights, real-life examples, and simplified advice to help you make better financial decisions.

Whether it’s choosing between paying off a loan or investing, building emergency funds, or planning for retirement — I love breaking down complex topics into easy, actionable tips that anyone can follow.

Let’s learn, grow, and build wealth — the smart way. 💰

good information brother