Sell property to clear debt :Then You Will Be Fine!

Debt is a sin for all people.

Why is it wrong to have debt, you might ask? Debt is what makes you worry at night and hang your head during the day.

The biggest mistake people with such debt make is holding on to their property. You might be wondering: “If I have debt, shouldn’t I have assets?” Sure—but do you really need to keep those assets?

Yes, sell everything you have. Put it up for sale without thinking twice.

But wait—read this before you sell property to clear debt

Debt is Almost Unavoidable, But…

Who are the people that are truly debt-free these days? sell property to clear debt

It’s true—it’s almost impossible to swim in the ocean of life (samsara) without borrowing at some point. In today’s world, living entirely debt-free seems like a fantasy.

But the real problem arises only when your debt reaches the point of being called “debt-ridden.”

Falling into the Pitfalls of Debt

Many people take loans without fully understanding the risks involved.

And no matter how much their debt increases, they refuse to sell their assets. Why? Because selling property to pay off debt feels like a matter of honor.

This mindset leads to dragging a burden of debt endlessly—and some people’s lives get buried under it completely.

Why? Because they don’t truly understand the nature of debt.

Why Not Use Assets to Pay Off Debt?

Taking one loan to pay another is a dangerous cycle.

If someone is already in debt, they should not be investing in new ventures or holding on to properties until the existing debt is cleared.

Not everyone wants to hear this—but there’s a powerful saying:

“Those who have no debt and no health problems are the richest.”

Once you hear that, it’s hard to disagree.

If you’ve taken a loan and miss your installments, the lender won’t stay silent. And yet, people hang on, believing “somehow I’ll pay it off.” But with what confidence?sell property to clear debt

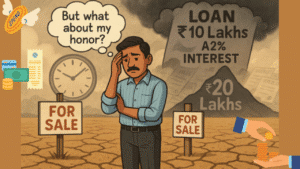

A Real-Life Example

-

A person owns land worth ₹10 lakhs.

-

At the same time, he has a ₹10 lakh loan at 2% interest.

-

He could easily sell the land and clear the loan.

But no—he says, “Selling land? That’s my honor at stake!”

Before holding on to the land, he should consider its value trajectory.

Even under ideal conditions, land value doubles only once every six years. Some may argue their land doubled in one year. That’s rare—and certainly not a rule.

On the other hand, a ₹10 lakh loan at 2% monthly interest will double in just four years, becoming ₹20 lakhs.

So ask yourself:

Is it really smart to protect a property while your debt keeps growing? sell property to clear debt

If you insist on that path, you might end up losing the property and still be stuck with the loan.

Let’s Understand This with an Example

Take the case of Ravi, a small business owner.

-

Ravi owns a piece of land valued at ₹10 lakhs.

-

Meanwhile, he has taken a private loan of ₹10 lakhs at a 2% monthly interest rate (24% per annum).

-

He’s paying ₹20,000 every month just in interest—and the principal amount hasn’t even started reducing.

-

He has the option to sell his land and clear the debt, but he says, “It’s a matter of my honor. I won’t sell.”

He’s holding on, hoping the land’s value will increase. Let’s say under ideal market conditions, the land doubles in 6 years. But in 4 years, his loan will already have doubled due to the interest—turning into a ₹20 lakh liability.

If the land stays stagnant or doesn’t increase fast enough, he’ll end up losing both—the land and his peace of mind.

By that point, selling the land might not even be enough to cover the total debt.

Lesson: Don’t wait until the situation becomes worse. Use your existing asset to cut the chain of compounding interest before it’s too late. sell property to clear debt

What Makes a Loan Good or Bad?

Not all debt is equal.

-

A home loan taken through a bank? That’s a good loan.

-

A private loan through non-bank sources? Almost always bad.

When someone takes a low-interest home loan, they often stress about repaying it. Why?

Let’s break it down:

-

You take a ₹50 lakh loan.

-

You agree to pay it off over 20 years.

-

The monthly EMI is ₹48,000.

Later, you realize that by the end of the loan, you’ll have paid ₹70 lakhs in total (including interest). You start questioning: “Is this worth it?”

But think again—aren’t you:

-

Paying ₹48,000/month and living in a ₹50 lakh house?

-

Avoiding rent, which is at least ₹13,000 today—and could be ₹26,000 in 10 years?

Your EMI never changes, but rent always increases.

So why stress?

If you’re paying ₹48,000 each month and enjoying the house—how else would you get a ₹50 lakh loan? Who else would lend that easily?sell property to clear debt

Final Thoughts

So yes—sell the property if you have to.

Debt isn’t just a financial burden; it’s emotional, mental, and deeply personal. But clinging to pride while ignoring the weight of loans could ruin your financial future. sell property to clear debt

Your freedom is worth more than your false sense of prestige.

✨ About Me

Hi! I’m Manikanta Reddy, a passionate finance enthusiast with a strong understanding of money management, personal finance, and smart investment strategies. I believe financial literacy is the foundation of a secure and stress-free life — and I’m here to share practical insights, real-life examples, and simplified advice to help you make better financial decisions.

Whether it’s choosing between paying off a loan or investing, building emergency funds, or planning for retirement — I love breaking down complex topics into easy, actionable tips that anyone can follow.

Let’s learn, grow, and build wealth — the smart way. 💰

1 thought on ““Why You Should Sell Property to Clear Debt Before It’s Too Late” 1CR”