SECTION 54F Want to Avoid Taxes on Equity Profits? Buy a House!

We often hear that the Sensex has hit record highs, and investors have seen their wealth multiply into crores. But alongside those growing profits comes another inevitable reality: taxes. What if we told you there’s a completely legal way to avoid paying taxes on those massive equity gains?

Yes, it’s possible — and the key lies in a clever provision in the Income Tax Act. If you invest your gains wisely, you could legally pay zero tax on profits made through equities, debt instruments, or even gold ornaments.

Let’s explore how.

Taxes and the Economy: The Bigger Picture

Before diving into the loophole, let’s acknowledge this — taxes play a vital role in a country’s development. They fuel welfare schemes, infrastructure projects, and much more. That’s why the government takes tax collection seriously.

But even within this strict framework, the government provides certain tax reliefs to promote specific types of behavior — like investing in property. One such golden opportunity for investors is Section 54F of the Income Tax Act, 1983.

What Is Section 54F?

Section 54F offers a tax exemption on long-term capital gains arising from the sale of equity, mutual funds, gold, or debt instruments, if those gains are used to buy a residential property.

Sounds too good to be true? It’s real — but there are some important conditions you need to meet.

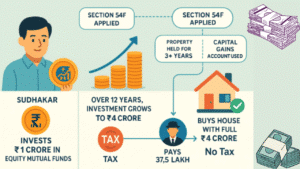

A Real-Life Example: Sudhakar’s Story

Let’s say Sudhakar invested Rs. 1 crore in equities.

-

With an annual return of 12%, it grew to Rs. 2 crore in 6 years.

-

In another 6 years, it doubled again to Rs. 4 crore.

-

His profit? A whopping Rs. 3 crore.

According to tax laws, Sudhakar would typically pay 12.5% capital gains tax on the profit. That’s Rs. 37.5 lakh straight to the government.

But Sudhakar didn’t want to part with that money. Instead, he took advantage of Section 54F. He used the entire Rs. 4 crore (investment + profit) to buy a residential property.

Result? No tax on his equity profits. All perfectly legal.

The Fine Print: Conditions You Must Meet

Don’t assume you can use this strategy every time you make a profit. Section 54F comes with a few strings attached:

-

Number of Houses:

-

You must not already own more than one residential property (excluding the new one).

-

If you already have two or more houses, you cannot claim this benefit.

-

-

Holding Period:

-

The new house must be held for at least three years.

-

If you sell it within three years, the exemption will be revoked, and you’ll be liable to pay tax.

-

-

Capital Gains Account Scheme:

-

If you’re not immediately purchasing the property, the gains must be deposited in a Capital Gains Account and later used from there to buy the house.

-

These rules ensure that only genuine long-term investors benefit — not those looking for quick tax-free flips.

Smart Moves Investors Make

To take full advantage of Section 54F:

-

Many investors purchase property in the name of their spouse or children to remain eligible.

-

Some even split investments across different family members to multiply the benefits.

As long as the money flows through the correct capital gains account and the property purchase aligns with the conditions, the tax exemption stands.

A Retirement Strategy: One-Time Settlement

Section 54F also opens doors for smart retirement planning.

If you’re a salaried employee frequently transferred between cities, it might not make sense to buy a house during your working years. Instead, invest in equity or mutual funds and let your wealth grow.

When you retire and decide where to settle, you can use your capital gains to buy a house and avoid taxes altogether. It’s a beautiful way to maximize returns and minimize tax.

Final Thoughts

Section 54F is a blessing for those who know how to use it. With smart planning, long-term patience, and correct documentation, you can:

-

Grow your wealth through equities.

-

Avoid hefty capital gains tax.

-

Secure a home — all at once.

But remember, this strategy comes with rules. Make sure to stay compliant, consult a tax expert when in doubt, and enjoy the benefits that the system allows.

Example: Tax-Free Equity Gains Through Property Purchase

Let’s walk through a practical example to see how Section 54F works.

🧍♂️Meet Sudhakar:

-

Initial Investment: Rs. 1 crore in equity mutual funds

-

Timeframe: 12 years

-

Returns: 12% annually

-

Final Value: Rs. 4 crore

-

Capital Gain: Rs. 3 crore

Now, under normal circumstances, Sudhakar would need to pay 10%–12.5% long-term capital gains tax on the Rs. 3 crore profit.

That’s up to Rs. 37.5 lakh in tax!

But Sudhakar chose to invest the entire Rs. 4 crore (original capital + profit) into a residential property. Since he met the following conditions:

✅ He owned only one house before

✅ He did not sell the new house for 3 years

✅ He routed the money through a Capital Gains Account Scheme

…he was fully exempt from capital gains tax under Section 54F.

Outcome:

Sudhakar saved nearly Rs. 37.5 lakh legally, while also acquiring a valuable asset.

✨ About Me

Hi! I’m Manikanta Reddy, a passionate finance enthusiast with a strong understanding of money management, personal finance, and smart investment strategies. I believe financial literacy is the foundation of a secure and stress-free life — and I’m here to share practical insights, real-life examples, and simplified advice to help you make better financial decisions.

Whether it’s choosing between paying off a loan or investing, building emergency funds, or planning for retirement — I love breaking down complex topics into easy, actionable tips that anyone can follow.

Let’s learn, grow, and build wealth — the smart way. 💰

1 thought on “How Section 54F Can Help You Save Lakhs in Taxes on Equity Profits”