Inflation and Investments: A Hard Lesson from the Past

Only then is it a profitable investment!

Even if the wings are clipped, it should at least be a meal. May the future turn out well! But if we don’t assess the future properly, all our hard work might turn to ashes.

Many people set long-term goals and commit their lives to them. They wait patiently for years. But the final result? Sometimes, it’s bitter. This is especially true for investments made without considering a rise in prices—they simply don’t bear fruit.

A Nostalgic Reminder: When Ten Rupees Was Enough

“In those days, we used to go to the cinema for just ten rupees—popcorn during the interval and a rickshaw ride back home,” said Kantha Rao with a smile.

Fast forward to today: a simple movie outing for two costs not less than a thousand rupees. That’s a rise in prices in action—quietly creeping into our lives and inflating costs.

The Car That Never Came: A Real-Life Story

Kantha Rao’s lifelong dream was to own a car. In 1986, when his salary was ₹870 per month, he bought a life insurance policy worth ₹1 lakh. The annual premium was ₹4,000—an amount that stretched his finances to the limit.

“Why so many sacrifices?” his wife Kantamma would ask.

He replied with pride, “It will give us ₹3 lakhs in the future! I’ll buy two cars—one for you, one for me—and we’ll build a proper house.”

Years passed. One day, the policy matured, and Kantha Rao received the full ₹3 lakhs. He was ecstatic—until he walked into a car showroom and discovered that the basic model now cost ₹3.5 lakhs.

His heart sank. The dream he had held onto for so long vanished. He could neither buy one car comfortably, let alone two, nor build a home.

The Value of Money Changes Over Time

What went wrong? a rise in prices. Kantha Rao didn’t account for how much prices would rise in the future. And when that happens, the money you’ve been saving diligently loses its power.

Whether it’s an insurance policy or any investment, the goal is always to meet future needs. But for that, the return must outpace inflation. Otherwise, it’s just a false sense of security.

Understanding the Real Impact of Inflation

A decade ago, a couple could live comfortably on ₹10,000 per month. Today, they might struggle with ₹25,000. That’sa rise in prices at work.

In India, the average inflation rate hovers around 7%. This means any investment or policy return must beat that 7% mark to be truly profitable. In some sectors like education and healthcare, inflation is even higher—12% and 14% respectively.

So, if your investments are not earning at least 12% annually, you’re losing money in real terms.

Smart Financial Planning: What You Can Do

To secure your future and beat inflation:

-

Live within your means: Ensure your monthly expenses don’t exceed 50% of your income.

-

Save and invest the rest: Even bank savings can help in emergencies.

-

Invest smartly: Look for investment avenues that offer returns above 7%. Mutual funds, despite short-term risks, are good long-term options.

-

Plan with inflation in mind: It’s not enough to save ₹10 lakhs today for your daughter’s wedding ten years from now. You need to invest it where it can grow, not shrink in value.

Final Thought: Predict the Future, Plan Today

It’s clear how much the world has changed in just ten years. Imagine how it could look in another ten.

Don’t let your dreams become distant memories like Kantha Rao’s car. Understand the power of a rise in prices, and make sure every rupee you save today can still stand tall tomorrow.

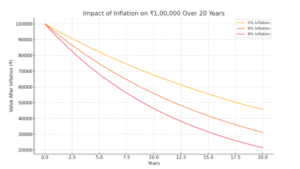

This clearly shows why your investments need to grow faster than inflation to maintain real value. Want a downloadable version of this chart?

Here’s an infographic showing how ₹1,00,000 loses value over 20 years under different inflation rates:

- At 4% inflation, it becomes ₹45,639 after 20 years.

- At 6%, it drops to ₹31,180.

- At 8%, it shrinks further to just ₹21,450.

do you want know about more information on inflation here it is :

🔍 What is Inflation?

Inflation is the rate at which the general level of prices for goods and services rises over time, reducing the purchasing power of money.

For example:

If inflation is 6% annually, something that costs ₹100 today will cost ₹106 a year from now (on average). This means your money buys less over time unless your income or investment returns increase accordingly.

📈 Causes of Inflation

There are several key reasons why inflation happens:

1. Demand-Pull

Occurs when demand for goods and services exceeds supply. Too much money chasing too few goods.

2. Cost-Push

Happens when the cost of production increases (e.g., raw materials, wages), pushing up prices.

3. Built-in

Also called “wage-price inflation.” Workers demand higher wages to keep up with the cost of living, which in turn increases business costs, leading to higher prices.

4. Monetary

When central banks print more money or reduce interest rates too much, it increases money supply and may lead to inflation.

📊 How it Measured?

In most countries, inflation is tracked using price indices. The most common ones in India are:

-

CPI (Consumer Price Index): Measures the average price change in a basket of household goods and services like food, transportation, healthcare, etc.

-

WPI (Wholesale Price Index): Measures price changes at the wholesale level.

India’s inflation rate typically ranges between 4% and 7%, but it can vary based on economic conditions.

💥 Why is Inflation Important?

✅ Moderate inflation is normal and healthy for a growing economy.

It encourages people to spend and invest rather than hoard money.

❌ High or unpredictable and dangerous:

-

Erodes the value of savings

-

Increases the cost of living

-

Hurts people with fixed incomes

-

Makes long-term financial planning difficult

🛡️ How to Protect Yourself

-

Invest wisely: Choose investments that beat inflation (e.g., stocks, mutual funds, real estate).

-

Avoid holding too much cash: Cash loses value over time due to a rise in prices

-

Diversify your portfolio: Don’t rely on a single investment type.

-

Review your financial goals periodically to adjust for a rise in prices

✨ About Me

Hi! I’m Manikanta Reddy, a passionate finance enthusiast with a strong understanding of money management, personal finance, and smart investment strategies. I believe financial literacy is the foundation of a secure and stress-free life — and I’m here to share practical insights, real-life examples, and simplified advice to help you make better financial decisions.

Whether it’s choosing between paying off a loan or investing, building emergency funds, or planning for retirement — I love breaking down complex topics into easy, actionable tips that anyone can follow.

Let’s learn, grow, and build wealth — the smart way. 💰

Inflation is silent killer really !