“Home Loan Myths Busted: Why Taking a Housing Loan Can Be a Smart Move”

🏠 Home Loan: Wrong Decision or the Right Move?

Have you been dreaming of owning a home but losing sleep over EMI payments? Does the thought of debt make you feel like it’s better to delay or avoid taking a home loan altogether? If you’re determined to pay off the loan early to reduce interest, you might not fully understand how home loans work. Don’t let fear or half-knowledge keep you away from your dream home. Jayant’s story will show you why! (“Home Loan Myths Busted: Why Taking a Housing Loan Can Be a Smart Move”)

💼 Meet Jayant and Kalyani

Jayant, a software engineer, and his wife Kalyani, who also works in the same company, earn a combined salary of ₹2 lakhs per month. With family responsibilities and a frugal lifestyle, they managed to save ₹15 lakhs. Ready to settle down, they found a flat in a prime area priced at ₹60 lakhs (including registration). They loved the place and approached the bank for a loan.

The bank approved a home loan of ₹50 lakhs, to be processed within two days. With ₹5 lakhs from their savings used towards the down payment, things seemed perfect—until the EMI calculations kicked in.(“Home Loan Myths Busted: Why Taking a Housing Loan Can Be a Smart Move”)

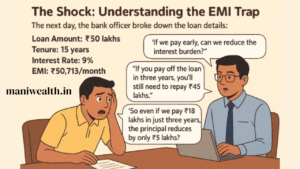

📉 The Shock: Understanding the EMI Trap

The next day, the bank officer broke down the loan details:

-

Loan Amount: ₹50 lakhs

-

Tenure: 15 years

-

Interest Rate: 9%

-

EMI: ₹50,713/month

Jayanth quickly did the math — 15 years of ₹50,713 a month meant they’d be paying over ₹91 lakhs for a ₹50 lakh loan. That’s ₹41 lakhs in interest alone! Their excitement turned into anxiety.

He asked, “If we pay early, can we reduce the interest burden?”

The officer replied, “If you pay off the loan in three years, you’ll still need to repay ₹45 lakhs.”

Jayanth was stunned. “So even if we pay ₹18 lakhs in just three years, the principal reduces by only ₹5 lakhs?”

Jayant even asked about early repayment. The officer told him that even if he repaid the entire loan in three years, he’d still need to pay ₹45 lakhs—barely a ₹5 lakh reduction on the principal. Jayant was confused and disappointed.

🤝 Enter Sudhir: The Voice of Financial Wisdom

Jayant turned to his friend Sudhir for advice. Sudhir laughed and said, “If you break down every loan like this, you’ll never buy a house!”

He gave a simple analogy: “If someone lent you ₹50 lakhs privately, you’d pay ₹50,000 interest monthly. But that amount wouldn’t reduce the principal at all. With a home loan, every EMI reduces your principal and interest step-by-step. Over 180 months (15 years), the interest component shrinks while the principal portion grows.”(“Home Loan Myths Busted: Why Taking a Housing Loan Can Be a Smart Move”)

🧮 Interest vs. Rent

Jayant still looked unsure. So Sudhir asked, “How much rent do you pay now?” Jayant replied, “₹16,000.”

“Exactly!” Sudhir exclaimed. “That’s the same money you’ll now use to pay off your own home. Rent is money gone forever. But every rupee of EMI is building your asset. And think about this—9% annual interest is just 0.75% per month. Plus, you get tax benefits on home loan interest and principal under Sections 80C and 24(b)!”

He concluded: “Don’t fear a loan that’s helping you create wealth. Take the leap.”

Reassured, Jayant smiled and said, “You’re the chief guest at our housewarming!”

“Home Loan Myths Busted: Why Taking a Housing Loan Can Be a Smart Move”

💡 Final Thoughts

Home loans aren’t as scary as they seem. When used wisely, they’re a financial tool to help you build wealth, gain independence, and stop the cycle of rent. Don’t let interest myths block your way—understand the process and make informed decisions.

✨ About Me

Hi! I’m Manikanta Reddy, a passionate finance enthusiast with a strong understanding of money management, personal finance, and smart investment strategies. I believe financial literacy is the foundation of a secure and stress-free life — and I’m here to share practical insights, real-life examples, and simplified advice to help you make better financial decisions.

Whether it’s choosing between paying off a loan or investing, building emergency funds, or planning for retirement — I love breaking down complex topics into easy, actionable tips that anyone can follow.

Let’s learn, grow, and build wealth — the smart way. 💰

Home Loan Myths Busted: Why Taking a Housing Loan Can Be a Smart Move”

Not everyone has the same luck

When it comes to investment, people first imagine the profits.For this, they search the formulas suggested by economists on the Internet. But, it should be remembered that money invested without a purpose will not be needed for the needs. Above all, the methods suggested by renowned economists are not universal and timeless. Investment plans based on a person’s income do not work out in advance. Investment avenues should be explored according to family circumstances and future needs. I am not saying to sit back and relax. Let’s not be complacent and pretend that we have no desire. We should try to increase our income. It is good to have the support of those who have financially supported us and to have a stable income! But, if such people have the attitude that whatever they do will be valid, it is dangerous. Why not.. there are many families who have gone to extremes and ended up in a mess!

Murder knife

You can murder with a surgical knife. But, you can’t do surgery with a surgical knife. The black money coming from real estate is also like a murder knife! You can’t do surgery with it. There is a big difference between the price fixed by the government and the market price in the case of land. No one has the intention of registering at the market price. The buyer pays the entire amount related to the government price in the form of a check. The rest is given as black money. The person who sells the land has to go through various difficulties to turn this black money into white! Because these days, even educational institutions and hospitals are taking liquid cash up to two lakhs. If you have to pay more than that.. no cash.. only check. The money has to be put back on the spot. Or, they are committing financial crimes and paying commissions to convert it into white.

12 thoughts on ““Home Loan Myths Busted: Why Taking a Housing Loan Can Be a Smart Move” 1”