Why Choosing the Right Home Loan Provider Matters: Bank vs NBFC Explained

Where to Take a Home Loan?

A middle-class person goes to all the banks for a home loan. He also resorts to financial companies. He provides all the documents asked for. He signs wherever he is asked. After the desired loan is sanctioned and he owns the house of his dreams, he bears the burden of installments. However, if this debt does not become even tighter, where he took the loan is very important! Why Choosing the Right Home Loan Provider Matters: Bank vs NBFC Explained

The Story of Dayanidhi

Dayanidhi is a private employee. He saw a flat in his budget. It seemed good. The family also liked it. He paid all his savings in cash. Even if he gets a loan of Rs. 40 lakhs, he will not own the house!

The builder said, “I know someone in a non-banking financial company (NBFC). This is how it will work.” As expected, the loan was sanctioned in fifteen days. The interest rate was fixed at 8.5 percent. He thought it was okay.

Dayanidhi! A year has passed. He approached a financial institution for some documents. He was shocked to see that the interest rate in the said documents was 11 percent. When he asked for an explanation, they said that the interest rates had increased! (Why Choosing the Right Home Loan Provider Matters: Bank vs NBFC Explained)

The Difference in Interest Rates

This is not the only situation of Dayanidhi! Many people are relying on financial institutions due to lack of knowledge in the matter of home loans. They are looking for other ways with the misconception that if they go to government banks, they will not get a loan quickly.

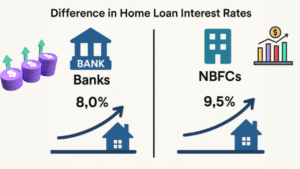

Although the interest rate on home loans in private banks is slightly different compared to government banks, it is not okay compared to financial institutions!

But many people are in a situation where they do not even know whether the loan was sanctioned from the bank or from the home finance company affiliated with the bank.

For example, if it is ICICI Bank, then ICICI Home Finance is a home loan company! Almost all banks have home finance companies. When it comes to interest rates, the difference between the rates offered by these finance companies and the bank can be seen clearly. (Why Choosing the Right Home Loan Provider Matters: Bank vs NBFC Explained)

Loss in Lakhs

The RBI reviews the interest rates of bank loans. Interest rates increase and decrease every three months according to changes in repo rates. Banks revise interest rates based on the Repo Linked Loan Rate (RLLR) as prescribed by the Reserve Bank.

Non-banking financial companies set their own interest rates. There is a huge difference of one to two and a half percent in the interest rates between bank interest rates and home finance companies of that bank. Some private companies charge even more interest.

In a long-term home loan, if the interest rate increases by one percent, you will have to pay an additional Rs. 4 lakh to Rs. 5 lakh. Therefore, if you own a house, it is not right to resort to non-banking financial companies without any hesitation.

If you have already taken a loan from an NBFC and it has not been more than a year or two, it is better to try to transfer it to a bank! Otherwise, you will be in trouble.

Why Choosing the Right Home Loan Provider Matters: Bank vs NBFC Explained

Only If Everything Is in Order…

A home loan is considered a secured loan. That is, banks will not give a loan of more than Rs. 80 lakhs for a house worth one crore rupees. If the EMI is not paid for three months, the bank officials have the option of giving a notice to the homeowner and auctioning the house to collect the loan.

Before giving a loan, the bank officials examine all the documents related to the property. They check with experts whether there are any legal implications of the property value, and they come forward to give a loan only if there are no problems.

In this process, sometimes the sanction of the loan may be delayed. Sometimes it may come less than expected. If there is a legal difference in the financial transactions or the documents related to the house, the loan is stopped.

In this context, some people resort to non-banking financial companies with the misconception that the bank loan will be delayed. They also give loans only after checking everything. If not, they show intransigence.

The weakness of wanting to get a loan quickly is what is making the common man knock on the doors of NBFCs. They should be resorted to only if they cannot get a loan from a bank.

Why Choosing the Right Home Loan Provider Matters: Bank vs NBFC Explained

✨ About Me

Hi! I’m Manikanta Reddy, a passionate finance enthusiast with a strong understanding of money management, personal finance, and smart investment strategies. I believe financial literacy is the foundation of a secure and stress-free life — and I’m here to share practical insights, real-life examples, and simplified advice to help you make better financial decisions.

Whether it’s choosing between paying off a loan or investing, building emergency funds, or planning for retirement — I love breaking down complex topics into easy, actionable tips that anyone can follow.

Let’s learn, grow, and build wealth — the smart way. 💰

1 thought on “Why Choosing the Right Home Loan Provider Matters: Bank vs NBFC Explained”