Thinking Ahead: Why Your Second Property Should Be Commercial, Not Residential

Isn’t one house enough to live in? Absolutely—one home is typically enough for living. But when you start planning for the future, a second property becomes more of a strategic asset than a necessity. The big question then arises: What kind of second property should you invest in?

For many, the default answer is another residential property. But those thinking commercially—and smartly—might want to consider commercial real estate instead.

The Usual Path: A Second House

In most families, especially those moving up from middle-class status, the idea of a second property often leans toward an apartment or an independent house. It feels safe, familiar, and manageable. People commonly say, “I have two houses in Hyderabad,” as a badge of financial progress. But what’s often overlooked is how much income that second house actually brings in.

Let’s take a closer look.

Suppose you invest ₹1 crore in a three-bedroom flat in a prime area. The rent you can expect? Roughly ₹30,000 per month, which totals ₹3.6 lakh per year. But here’s the catch:

-

You might face vacancy periods of one to two months every year.

-

You’ll be responsible for repairs and maintenance.

-

Rent hikes are typically capped at 5% every two years—and only if the same tenant stays.

-

You may have to deal with tenant issues, neighbor complaints, and unexpected disruptions.

While the property value might appreciate over time, the monthly cash flow is limited and uncertain.

Now Think Commercial

If you’re financially flexible and mentally ready to go beyond your comfort zone, a commercial property can offer far better returns.

Take that same ₹1 crore investment and consider this:

-

A commercial property can fetch ₹40,000 to ₹50,000 per month in rent—₹4.8 to ₹6 lakh per year.

-

You can even buy 2–3 small shops in a town or district center with that budget.

-

If one shop remains vacant temporarily, the others continue generating income.

-

Commercial tenants, especially businesses doing well, tend to stay long-term—often 5 to 10 years.

In recent times, commercial units in malls—ranging from 300 sq. ft. to several thousand—are legally available for purchase. If you manage to acquire even 500 sq. ft. in a good location, the rent potential can cross ₹50,000/month. Plus, resale prospects are excellent—you can expect double the value in just a few years.

The Bigger Picture: Returns & Loans

When you already have a home to live in, buying commercial real estate as your second investment can be a game-changer. The return on investment (ROI), even after accounting for depreciation, can hover around 12% annually.

Of course, financing plays a big role:

-

Home loans come with lower interest rates and up to 85% financing.

-

Commercial loans typically have higher interest rates and slightly lower loan-to-value ratios.

However, if you can adjust for this difference, your second property becomes a reliable income stream—one that can support your retirement or even replace your primary income in the long term.

Final Thoughts

Buying a second house might give you peace of mind. But thinking commercially brings profit to the table. A second property shouldn’t just sit there—it should work for you, generating consistent income and offering high appreciation potential.

So, if you’re financially stable and ready to take the next step, look beyond the conventional. Invest in commercial property. Your future self will thank you.

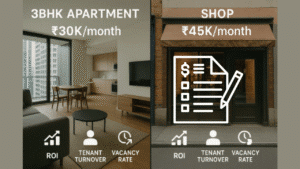

🏠 Example 1: Residential Flat vs Commercial Shop (₹1 Crore Budget)

Option A: Buy a 3BHK Flat in a Prime Area (₹1 Cr)

-

Rental Income: ₹30,000/month

-

Yearly Return: ₹3.6 Lakhs

-

Vacancy: 1–2 months possible per year

-

Expenses: Repairs, society maintenance, property tax

-

Tenant Turnover: Likely every 1–2 years

-

Net Return: Approx. 3–3.5% annually

Option B: Buy a Commercial Shop in a District Center (₹1 Cr)

-

Rental Income: ₹45,000/month

-

Yearly Return: ₹5.4 Lakhs

-

Vacancy: Low; tenants usually stay longer

-

Expenses: Maintenance paid by tenants

-

Tenant Turnover: Low, 5–10 years

-

Net Return: Approx. 5–6% annually + Higher capital appreciation

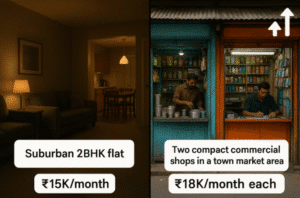

🏢 Example 2: Small Budget – ₹50 Lakhs

Option A: 2BHK Apartment in Suburbs

-

Rent: ₹15,000/month

-

Annual Return: ₹1.8 Lakhs

-

Vacancy Risk: Moderate

-

Net ROI: ~3–4%

Option B: 2 Small Shops of ₹25 Lakhs Each

-

Rent per Shop: ₹18,000/month

-

Total Rent: ₹36,000/month or ₹4.32 Lakhs/year

-

Net ROI: ~6–7%

-

Bonus: Even if one shop is vacant, other keeps earning

🛍️ Example 3: Mall Unit Investment (₹60 Lakhs)

-

Buy a 300–400 sq. ft. unit in a local mall or high-footfall commercial complex.

-

Rent potential: ₹45,000–₹55,000/month

-

Stability: Retail tenants stay for long-term contracts (3–10 years)

-

Capital appreciation: Very high if the mall gains popularity

🏗️ Example 4: Build-to-Rent Strategy on Land (₹80–90 Lakhs)

-

Buy roadside land (~₹50 Lakhs)

-

Construct 2–3 basic commercial sheds or shops (~₹30–40 Lakhs)

-

Monthly Rent: ₹12,000–₹20,000 per shop (Total: ₹40,000–₹60,000/month)

-

Bonus: Land value appreciates independently

✨ About Me

Hi! I’m Manikanta Reddy, a passionate finance enthusiast with a strong understanding of money management, personal finance, and smart investment strategies. I believe financial literacy is the foundation of a secure and stress-free life — and I’m here to share practical insights, real-life examples, and simplified advice to help you make better financial decisions.

Whether it’s choosing between paying off a loan or investing, building emergency funds, or planning for retirement — I love breaking down complex topics into easy, actionable tips that anyone can follow.

Let’s learn, grow, and build wealth — the smart way. 💰

1 thought on “Why Your house is Second Property Should Be Commercial — Not Just Another House”