Should You Buy a House at an Auction? Here’s What You Need to Know

Owning a home is a dream for many—but turning that dream into reality isn’t always easy. Often, the house we desire falls outside our budget, and settling for a lower-budget home may not be appealing. In such cases, many people look to bank-conducted property auctions as a promising opportunity. One such initiative is Ashadeepam, a property auction conducted by bankers.

But before you jump into buying a house at a bank auction, it’s essential to understand the benefits—and the risks.

Why Auctioned Homes Are Cheaper

Houses sold at bank auctions are typically priced about 20% lower than the open market. This attracts many hopeful buyers who are determined to own a good house at a reduced cost. But why are these homes cheaper?

-

Loan Limitations: Banks generally grant home loans of only up to 80% of the property’s value, especially if it exceeds ₹30 lakhs.

-

Loan Deductions: The value further decreases if the original owner has already paid a few installments over a year or two.

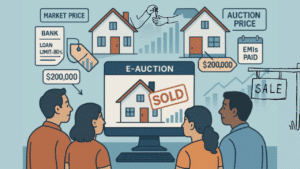

Because of these factors, the auction price is usually lower than the market price, increasing competition. Ultimately, the house goes to the highest bidder in the online e-auction.

The Hidden Challenges

At first glance, buying an auctioned home seems like a win. But there are potential drawbacks that could affect your long-term satisfaction.

-

Limited Loan Options: Not all banks offer loans for auctioned properties. You may have to rely on non-banking financial companies (NBFCs), which generally charge higher interest rates.

-

Increased Financial Burden: Even if the house is cheaper, the high interest rates could nullify the savings, leading to a higher overall payout.

-

No Sale Deed: Banks provide only a sale certificate, not a traditional sale deed. This could create complications if you ever need to take a loan on the property in the future—for example, for your child’s education or wedding.

That’s why experts advise caution, especially if you’re buying your only property. The risks may not be worth the initial savings.

Who Should Consider Auctioned Properties?

Buying at auction might not be ideal for everyone. People who already own a house may be better positioned to take on the associated risks and uncertainties. They usually have more flexibility and are less dependent on the property fulfilling immediate or long-term needs.

Do Your Homework

Before participating in any auction, it’s crucial to investigate thoroughly:

-

Legal Clarity: Don’t assume a bank sale is free of legal complications. Always consult a legal expert to verify the property’s documents.

-

Understand the Backstory: It helps to know why the homeowner defaulted. Was it financial hardship or another issue? Understanding the reason can help you assess potential risks.

-

Emotional Readiness: If you don’t genuinely like the house, don’t buy it just because it’s cheap. You may regret paying EMIs for years on a property you don’t love.

How the Auction Process Works

-

Default Notice: If a homeowner fails to pay loan installments for three months, the bank sends notices.

-

Final Warning: After an additional three-month window without response, the bank notifies the borrower that the property will be auctioned.

-

Legal Process: If there’s still no resolution, the bank initiates legal proceedings and puts the property up for auction.

-

Online Auction: The auction is conducted online. Interested buyers must pay a 5% deposit to participate.

-

Winning Bid: The highest bidder is required to pay 20% of the price within the bank’s specified time and the remaining within 40 days.

Final Thoughts

Buying a house at a bank auction like Ashadeepam can be a great way to get a property at a discounted price. However, it’s not without its complexities. Think beyond the immediate cost—consider financing, legal clarity, and your emotional connection to the home. Only after a thorough evaluation should you move forward.

A dream home isn’t just about price—it’s about peace of mind.

What Buying at Auction Looks Like in Practice

Let’s say Rajesh is looking to buy a home in Hyderabad. His budget is ₹50 lakhs, but every property he likes in the market is priced at ₹60–65 lakhs. One day, he comes across an auction notice for a 2BHK flat listed at ₹48 lakhs through a bank auction under the Ashadeepam scheme.

Why It Seems Like a Great Deal

-

The same flat is priced at ₹60 lakhs in the open market.

-

Rajesh thinks he can save ₹12 lakhs by going through the auction.

The Process He Follows

-

Initial Deposit: Rajesh pays a 5% deposit (₹2.4 lakhs) to participate in the online auction.

-

Winning the Auction: He places the highest bid and wins.

-

Payment Terms: He has to pay 20% (₹9.6 lakhs) within a few days and the remaining ₹38.4 lakhs within 40 days.

The Hidden Challenges He Faces

-

Loan Trouble: His bank refuses to finance the property because it’s an auction sale.

-

Turns to an NBFC: He secures a loan from an NBFC at 11.5% interest—higher than the 8.5% offered by banks.

-

Long-Term Cost: Over 20 years, he ends up paying almost the same as he would have for a ₹60 lakh property with a lower interest rate.

Future Impact

-

Rajesh later wants to take an education loan for his daughter, using the house as collateral.

-

But since he only has a sale certificate and not a registered sale deed, the bank declines the loan application.

Was It Worth It?

While Rajesh initially felt he got a great deal, the high interest rate and legal limitations made the purchase less beneficial in the long run.

✨ About Me

Hi! I’m Manikanta Reddy, a passionate finance enthusiast with a strong understanding of money management, personal finance, and smart investment strategies. I believe financial literacy is the foundation of a secure and stress-free life — and I’m here to share practical insights, real-life examples, and simplified advice to help you make better financial decisions.

Whether it’s choosing between paying off a loan or investing, building emergency funds, or planning for retirement — I love breaking down complex topics into easy, actionable tips that anyone can follow.

Let’s learn, grow, and build wealth — the smart way. 💰

1 thought on “Buying a House at a Bank Auction: Smart Deal or Hidden Risk?”